New-issue volume in January increased 5.3% year-over-year, as the municipal market entered 2009 facing a world drastically different than a year ago.

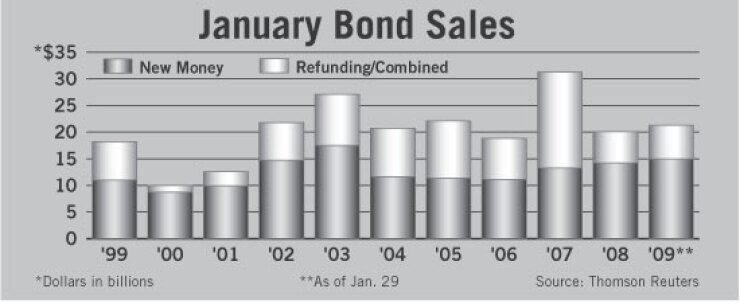

A total of 511 new-money and refunding issues came to the market in January with a par value of $21.2 billion, according to Thomson Reuters data. That compares to the 776 deals with a par value of $20.2 billion that came to market in January 2008, when the cracks beginning to show in the bond insurance market helped slow new issuance.

A total of 380 new-money issues with a par value of $14.97 billion came to market in January, a 5.3% increase from last year. That marks the highest new-money volume in any January since 2003.

The municipal market opened strong in January, following up on two weeks of firmness to end 2008. The Bond Buyer 40 Index of municipal bonds rose from 91.03176 on Dec. 15 to 103.8909 on Jan. 15 without a day of losses. The index retreated to end January before gains the final three days.

"January was just a moonshot to start, and then it got a little pricey and then got a little bit back," said John Mousseau, vice president and portfolio manager at Cumberland Advisors Inc.

As at the end of 2008, retail continued to drive the market. Institutional demand has weakened for a number of reasons, including the loss of arbitrage funds that had helped drive volumes to new records in recent years.

The market continues to be difficult for lower-rated issues as the stratification between high-grade and other types of credits holds. Although it has narrowed in recent weeks, the spread between a triple-A, 30-year general obligation bond and a single-A, 30-year GO stood at 84 basis points at the close on Friday, compared to 51 basis points a year earlier, according to Municipal Market Data.

"The demand clearly is in ... high grades," said Jonathan Nordstrom, managing director and head of underwriting, trading, and sales at Morgan Keegan & Co. "We have continued to see the lesser credits out of favor. And there's wonderful opportunities in A-rated GO and essential purpose revenue bonds for retail, and I think retail is taking advantage of historically wide spreads."

The largest issues to come to market in January included a $1.08 billion Empire State Development Corp. offering that included taxable credits, a $744.2 million Salt River Project, Ariz., deal, and a $650 million New York City Transitional Finance Authority issue. The average deal size in January also increased to $41.53 million from $25.98 million.

The competitive market continued to show stress in January. The volume of competitive deals fell 28.9% to $3.6 billion, mirroring a trend that began in 2008.

Spreads between the low, cover, and high bids on competitive deals tend to be wider than in the past, according to Nordstrom. This reflects that "there is still a lot of fear and uncertainty and that the market is trying to find the right level," he said.

Amid the global financial crisis, many of the parent companies of the municipal market's largest firms have racked up billions in losses. This has led them to cut staff and pull back resources across the board, including in their municipal groups.

It appears as though "dealers are really still in the mode of taking absolutely no risks," Mousseau said. That has led to a disconnect between the primary and secondary markets, he said, noting that a recent deal priced for the New York Yankees immediately traded up four to five basis points when it hit the secondary.

"Even competitive deals are not priced as expensively as they used to be, and negotiated deals are leaving nothing to chance in terms of the way they're being priced," Mousseau said. "That's good from an investor's standpoint; I'm not sure how good it is from an issuer's standpoint."