BRADENTON, Fla. — Georgia next week plans to bring $700 million of new-money and refunding general obligation bonds to market. As much as $400 million of the offering is expected to sell as the state’s first taxable Build America Bond transaction.

A combined $600 million of new-money bonds will be used for various capital projects such as higher education construction, transportation funding, and water and sewer projects. If market conditions cooperate, $100 million of refunding bonds will be sold for debt-service savings of 4% within existing maturities.

Goldman, Sachs & Co. is the book-runner on the transaction, which is expected to be sold in four series. Other underwriters in the syndicate are Barclays Capital, Citi, Jackson Securities LLC, Jefferies & Co., JPMorgan, Merrill Lynch & Co., Morgan Keegan & Co., Morgan Stanley, Stern, Agee & Leach Inc., and Wells Fargo Securities.

Public Resources Advisory Group is the state’s financial adviser. King & Spalding LLP is bond counsel. Disclosure counsel is Kutak Rock LLP. Underwriters’ counsel is Sutherland Asbill & Brennan LLP.

The transaction is expected to be structured as $85.5 million and $114.5 million of tax-exempt GOs designated as Series 2009F and G bonds, $400 million of Series 2009H taxable BABs, and $100 million of Series 2009I tax-exempt GO refunding bonds.

According to the preliminary official statement, the 2009F bonds are not expected to be subject to redemption prior to maturity. The 2009G bonds are expected to be callable after 2019. The 2009H BABs are expected to have extraordinary redemption provisions, while the 2009I refunding bonds — if sold — can be redeemed after 2019. Each series of bonds will be sold with various maturities but none over 20 years.

The final structure of each series and the amount of BABs sold will be determined at pricing, which begins Monday, said Susan Hart Ridley, director of the Georgia Financing and Investment Division.

The new debt being sold next week was authorized in May, when Gov. Sonny Perdue signed a $18.6 billion budget for fiscal 2010 that contained $1.2 billion of new borrowing. The budget, which took effect July 1, also authorized the use of Build America Bonds, Ridley said.

“At this point, the BABs should prove cost-effective for us in certain maturities,” Ridley said in an interview Tuesday. “We’re currently contemplating a make-whole call provision with an extraordinary redemption feature at any time.”

That call feature would come into play in the event that the 35% interest subsidy the state expects to receive for the BABs from the federal government under economic stimulus provisions is reduced or eliminated, according to the POS.

“We expect strong market acceptance” when the bonds sell, Ridley said.

The tax-exempt bonds are currently scheduled to begin selling on Monday with a retail order period followed by institutional sales on Tuesday. The BABs also are slated to begin selling on Tuesday.

The remainder of the bond authorization for fiscal 2010 could be sold as early as next spring, Ridley said.

Georgia is typically rated triple-A by Fitch Ratings, Moody’s Investors Service, and Standard & Poor’s. Ratings for next week’s bond sale had not been released at press time.

The state’s gilt-edged ratings were last affirmed in advance of a $314.5 million GO bond sale on May 6. All three rating agencies also maintained stable outlooks on Georgia’s credit even amid declining revenue, but they noted that state officials have long displayed strong fiscal management practices.

The May sale garnered some of the lowest interest rates in Georgia’s history.

The state sold $9.5 million of five-year GO bonds and $305 million of 20-year GO bonds. The proceeds will fund new school buildings, public safety projects, hospital improvements, and other infrastructure projects.

The state locked in a rate of 1.54% on the five-year bonds — the lowest rate in Georgia’s history — and 3.8% for the 20-year bonds, which represented the second-lowest rate for the state.

Market conditions were so favorable during pricing that officials upsized the deal by adding a $149.7 million GO refunding piece with 10-year maturities, which captured net savings of $32.6 million on the refunding of GOs issued between 2001 and 2003 without extending maturities.

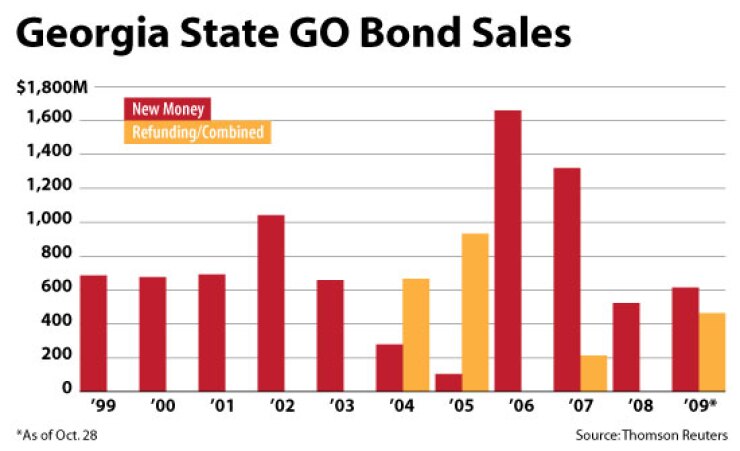

Next week’s deal will be the third negotiated offering from Georgia this year.

While the state typically sells its debt competitively, officials said the credit crisis that began in earnest last fall prompted them to turn to negotiated sales to navigate the changing municipal bond market.

The state priced its first-ever negotiated new-money offering Feb. 4 with the sale of $61.8 million of Series 2009A bonds and $552 million of 2009B bonds. The Series B bonds priced to yield 0.50% with a 2% coupon in 2010, 2.99% with a 4% coupon in 2019, and 4.64% with a 4.5% coupon in 2019.