A New York county's decision to opt for short-term debt instead of locking in long-term rates during a difficult market last December looks like it will pay off.

Nassau County will take bids for $150 million of tax-exempt general obligation bonds today and the proceeds will primarily be used to take out $125 million of bond anticipation notes that gave the county access to low short-term rates when long-term rates would have been higher than they hope to get today.

"We actually had teed up a bond deal in the second week of December and the market for bonds just evaporated," said Nassau debt manager Jeff Nogid. He said their underwriter told them they would be looking at coupons in the 6% to 7% range with yields of 6% if they went with bonds. Instead they went with Bans and got a 1.25% yield on a 2.5% coupon.

"It worked out," Nogid said. "It was a good financial move in a time of extreme financial stress."

By the time Nassau was ready to go out with bonds again in April, yields had fallen and they achieved a 4.11% true interest cost on $114 million of bonds. The county had nine bidders on that deal, which priced competitively in two series. Citi won the deal and at bidder's option insured the bonds with Assured Guaranty Corp.

A 10-year maturity on $99 million of general improvement bonds yielded 3.35% on a 5% coupon. This compared to 2.8% on 10-year maturity on Municipal Market Data's triple-A GO index.

Nogid said he expects the true interest costs to be closer to a 5% yield on the new issue because they have maturities out to 30 years compared to 25 years in the April deal.

The bonds will be marketed in two series: $135.3 million of Series 2009C general improvement bonds and $14.7 million of Series 2009D sewer and storm water resources district bonds.

Public Financial Management Inc. is financial adviser on the deal and Orrick, Herrington & Sutcliffe LLP is bond counsel.

While Nogid said they weren't trying to time the market, last year's turmoil does provide an incentive to get things done quickly.

"Last year everything melted down after the summer - who knows what's going to happen this year?" Nogid said. "Get it done when you're ready to do a deal. We're ready to do a deal."

The reason for the longer maturities on the current deal is "both the [longer life of the] assets that are getting financed and our view that the market has the appetite to go out 30 years," said Nancy Winkler, managing director at PFM. "We do feel more confident about the market."

Like the April deal, today's deal has bidder's option for insurance and Assured Guaranty has pre-approved the deal.

"We'll see whether or not it goes insured. If it goes insured it will probably all go retail, if it doesn't go insured the investor base will be different," Winkler said.

Matthew Sinni, assistant vice president at Assured Guaranty, said they were comfortable with Nassau's credit.

"They're facing challenges that are primarily driven by macro events and have done a great job managing themselves through this tough time, through the recession," Sinni said. "We see ourselves as partners with the county and helping them address their needs by helping them achieve interest cost savings. They've done some things like convert their variable-rate date and they plan to do some more of that, giving them more budgetary certainty with respect to their debt costs."

Moody's Investors Service rates the county Aa2. Fitch Ratings and Standard & Poor's rate it A-plus.

In a rating report, Moody's cited the county's proximity to New York City, wealthy demographic profile with a per capita income that's 160% of the nation, and housing values that are 260% of the nation. With a population of more than 1.3 million, Nassau is vulnerable to the housing downturn, with median single-family home prices having fallen 20% from their 2007 peak, the report said. The county is also vulnerable to job losses on Wall Street.

"The general recession is a concern," said Moody's analyst Lisa Cole. "Where we're seeing the most immediate impact in Nassau County is in the sales tax, which has been so underperforming, particularly this year. It's certainly a concern and we've been watching the county's response, which has been strong to date."

Cole said the drop in sales tax receipts was due to people spending less.

Moody's will also be paying attention to what Albany does with a sales tax extender. Counties in the state get a 3% sales tax but if they want to raise that rate, they have to get permission from the state Legislature, which has granted higher rates with two-year extenders.

Nogid said Nassau is counting on Albany to pass a 1.25 percentage point increase to give them a 4.25% sales tax. Their extender ends in November and is worth roughly $270 million.

"That's certainly a big piece of revenue for them," Cole said. "They would certainly need to see that passed. It's something we will be watching."

Nassau expects it will have to close a $2.7 million operating deficit in the current year, according to the preliminary official statement. This is primarily due to falling sales tax revenue that is now projected to come in at $962.4 million for the current year, a drop from the $1.04 billion projected in the adopted budget.

The county is also due to receive $10.5 million less state aid than the budgeted $230.3 millon. Nassau has taken cost saving actions and expects to benefit from $40 million to $45 million of additional Medicaid funds available from the federal stimulus package.

Also waiting on approval from Albany is authorization to sell bonds to pay for a retirement incentive program for union employees. The county won't know how much in bonds it will need to sell for the program until it's known how many employees accepted the package, but Nogid estimated it would be between $50 million and $100 million.

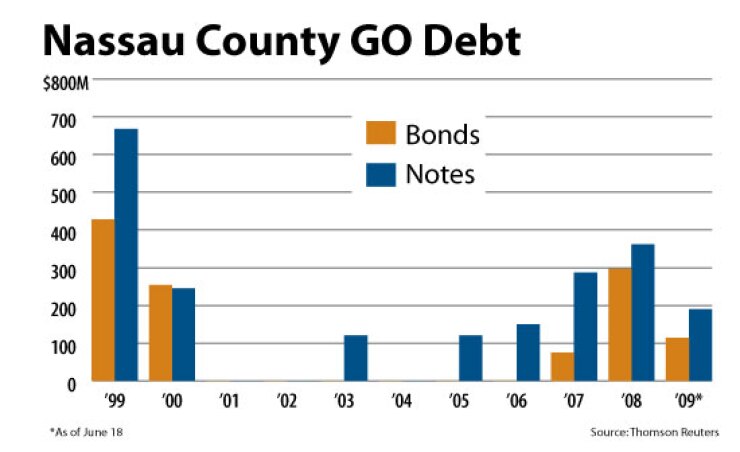

Nassau stopped selling bonds from 2001 through 2006 when a fiscal crisis gave rise to the Nassau County Interim Finance Authority, which sold $1.17 billion of bonds during that time, according to Thomson Reuters. Known as NIFA, the agency's authorization to sell new-money bonds has expired but it can continue to refund its own debt and plays an oversight role that Cole said was viewed as a positive.

The county has $1.1 billion of parity debt outstanding, of which 25% is variable rate.

"They do have exposure [to variable-rate debt] that we are monitoring, but they are managing that vulnerability so far," Cole said.