After a nearly seven-year hiatus from new-money bond issuance, Waterbury, Conn., is poised to sell at the end of this month $320 million of taxable pension bonds to help reduce its $460 million unfunded pension liability.

The city expects to follow this sale with an additional general obligation borrowing in 2009.

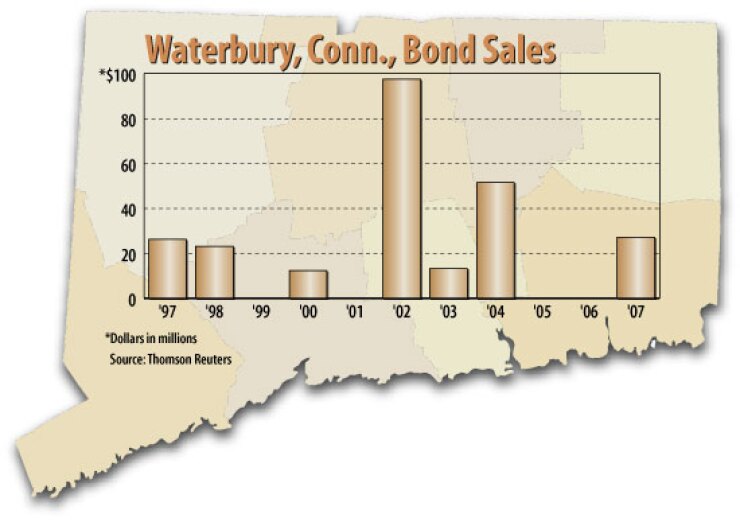

Aside from the occasional refunding and a $10 million new-money note sale in September of last year, Waterbury removed itself from the municipal bond market after officials sold $97 million of deficit bonds in 2001 to help balance the city budget. Now, with six consecutive years of operating surpluses under its belt and a projected $1 million surplus for fiscal 2008, which ends June 30, Waterbury is addressing its unfunded pension liability.

The $320 million of taxable bonds are set to price on May 28 or 29, with William Blair & Co. underwriting the deal. Webster Bank is the financial adviser and Shipman & Goodwin LLP is bond counsel. The pension bonds will be insured by Assured Guaranty Corp., according to John Jedrzejczyk, Waterbury's director of finance.

Moody's Investors Service assigns its Baa1 rating to the transaction, with a positive outlook. The bonds also carry a Moody's global scale rating of Aa2. Standard & Poor's and Fitch Ratings will also rate the sale.

The city is rated BBB and BBB-plus by Standard & Poor's and Fitch Ratings, respectively.

Current plans include the bonds being structured as fixed-rate with 30-year maturities.

"That's the structure that we're looking at right now," Jedrzejczyk said. "Although we were looking at other options, a blended structure, we've settled on a traditional, fixed-rate bond issue."

City officials anticipate the pension bond proceeds will boost the system's funding ratio to 70% from 11.5%. Yet, funding the program via pension bonds will turn Waterbury's soft $460 million liability into a hard liability and increase debt service costs for the city. Jedrzejczyk said Waterbury's budget can absorb the increase to debt service by decreasing its employer contribution to the retirement system.

"The cost of funding the actuarial or the ARC [actuarially required contributions] is another part of the budget. Those numbers are imbedded in the operating budget whether it's part of our debt service budget or whether it's part of our employee benefit budget, it's somewhere in the budget," Jedrzejczyk said. "One goes up, one goes down but really the benefit goes to the taxpayer because we're able to finance that liability at a lesser cost."

The city anticipates it will save more than $100 million over the life of the bonds by issuing the debt, and pegs annual investment return on the system at 8.5%, according to a Moody's report. While the credit agency believes that level is "aggressive," the program could sustain lower returns for a period of time.

"Financial projections prepared by the city's financial advisors evidence that the city will benefit from the investment of [pension obligation bond] proceeds compared to paying the ARC in each of the next four years even if the investments yield 0%," according to the Moody's report.

Waterbury's pension program currently contains 3,859 participants, of which 2,106 are retired. While officials have discussed replacing the pension program, or defined benefit plan, with a defined contribution plan such as a 401K program, the city has yet to begin analyzing the pros and cons of altering its retirement benefit system, Jedrzejczyk said.

In addition to the $460 million pension deficit, Waterbury has a $604 million unfunded liability in other post employment benefits. The city has approximately $162 million of outstanding debt, including the $97 million of 2001 deficit bonds and $66 million of sewer bonds, according to Jedrzejczyk.

Needed school construction, roadway projects, and a nearly $36 million renovation to its city hall will bring Waterbury back to the municipal market in September with $10 million of short-term borrowing and again in the fall of 2009 and fall of 2010 with combined note and bond deals. The city anticipates selling roughly $60 million in short-term and long-term debt in September 2009.

"We're starting to get very active in improving our facilities here after a long period of really not issuing bonds and notes for projects like that," Jedrzejczyk said. "If they've done anything in the past, they've managed to do that through local appropriations or through grants, but now the projects are getting larger and larger and that's not possible."