BRADENTON, Fla. - Fitch Ratings Wednesday assigned a negative outlook to all of Cape Coral, Fla.'s debt and cited the distressed housing market and property tax reforms.

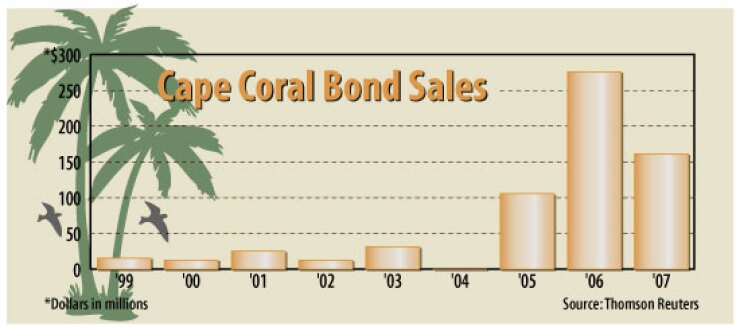

Fitch affirmed its A-plus rating on the city's approximately $3 million of outstanding general obligation bonds as well as the A rating on the city's $200 million of water and sewer bonds and the A-minus rating on $167.4 million of wastewater assessment bonds.

"The negative outlook on the bonds reflects Fitch's growing concerns that a distressed housing market, recently enacted property tax reform, and passage of Amendment 1 will result in increased budgetary pressures for the already stressed city," analyst Jennifer Brown said in a report.

Amendment 1, passed in a statewide referendum in February, is a legislatively mandated tax relief package aimed at cutting city, county, special district, and school taxes by $9.3 billion over five years. The amendment increased the homestead exemption and placed a 10% cap on annual assessments of all non-homestead properties limiting the amount local governments can raise through taxes.

Fitch said foreclosures in the Cape Coral-Fort Myers area along the west coast of the state have increased significantly. RealtyTrac said during the first quarter of this year, Florida had the nation's fourth-highest foreclosure rate - one in every 97 households.

In Cape Coral, new construction has declined about 77% in the current fiscal year, compared to in 2007, and property tax revenues have been affected by a 3% decline in taxable assessed value as a result of tax reform and a decline in home values.

"The outlook revision to negative reflects concerns that a planned draw down of general fund reserves in fiscal 2008 will reduce the unrestricted balance to a level inconsistent with the rating category," Brown said. "Maintenance of the rating will depend on the city's ability to maintain adequate financial flexibility while adjusting revenues and expenditures to support a structurally balanced budget."

Brown said there are pressures on other areas of the budget as well. Assessments are placed on property tax bills. When bills aren't paid, a tax certificate is sold and the assessment is paid. But if the tax certificate isn't sold, the assessment isn't paid.

The number of tax certificate sales increased in 2007 to 9.520, up from 6.248 in 2006. Fitch said a decline in tax and assessment collections could decrease already narrow coverage on the assessment bonds and place downward pressure on the rating.

On the city's water and sewer bonds, annual debt service coverage decreased to 1.14 times in fiscal 2007, from 2.44 times in fiscal 2006. Days' cash on hand for the system decreased to 17 in 2007 from 100 in 2006. Brown said maintenance of the current A rating would depend on the city's ability to maintain debt service coverage ratios and liquidity margins consistent with the rating category.