CHICAGO - Cleveland Public Power will enter the market Thursday with $100 million of public power system revenue bonds in a sale that will wipe out all the utility's remaining auction-rate debt as well as finance an expansion into several new areas of the city.

It is the first time in 14 years Cleveland has issued new-money debt for CPP and the borrowing is part of a plan that officials hope will make the utility more competitive, as it is one of only a few throughout the nation that compete for customers.

After months of planning on the new-money piece of the deal to finance expansion plans, CPP officials decided recently to add a refunding tranche to the transaction to restructure about $20 million in auction-rate refunding debt that has failed recently at auction. The move will shift all of CPP's debt - roughly $260 million - to a fixed rate.

"This gave us the opportunity to add on this piece of it," said Cleveland's debt manager Elizabeth Hruby, who added that auctions for most of CPP's outstanding auction-rate debt have failed over the last seven weeks. Those failures have led to interest rates as high as 7.8%, with the debt capturing interest rates around 6.9% in more recent auctions. The maximum is set by a formula fixed in the bond documents.

The rest of this week's issue will raise new money.

Lehman Brothers is lead manager on the transaction, with co-managers JPMorganand Loop Capital Markets LLC, and perhaps additional firms, Hruby said. Bond counsel is Squire, Sanders & Dempsey LLP, while Steven Hoffmann from Government Capital Management is financial adviser.

City officials chose Lehman because they liked the bank's suggestion that the borrowing include both current-interest bonds as well as capital appreciation bonds, helping the city utility better manage its cash flow, Hoffmann said.

"Their concept was basically to spread the amount of the borrowing as much as possible between as much current-interest bonds as CPP felt was advisable, and then doing the balance of the borrowing with capital appreciation bonds. Part of the reason is the existing debt service will be totally paid off in 2024," Hoffmann said. "And the capital appreciation bonds don't begin to repay until 2025."

The structure also matches what officials believe will be the life of the service projects. "With this expansion, there were clearly 30-year projects that we extend over that horizon," Hruby said.

The city did not consider the recent failed auctions - on which Lehman was the banker - sufficient reason to choose another underwriter, Hruby said. "They're not the only firms that have failed," she said. "These bonds are insured by [Financial Guaranty Insurance Co.] and that's a large part of the problem."

FGIC, a former triple-A insurer which has now stopped writing new business, is rated Baa3 by Moody's Investors Service, BB by Standard & Poor's, and BBB by Fitch Ratings.

CPP's upcoming bonds will be insured by MBIA Insurance Corp. "When we worked out the numbers, it was much more economical to use the insurance, especially doing capital appreciation bonds," Hoffmann said. Last week, Fitch downgraded MBIA to AA from AAA with a negative outlook. The insurer is rated Aaa by Moody's and AAA by Standard & Poor's.

The bonds are secured by a first lien on the net revenues of CPP.

The move to refinance CPP's outstanding ARS comes a month after Cleveland officials won City Council approval to move ahead with a plan to restructure all of the city's outstanding auction-rate debt. The city plans to sell $440 million of variable-rate demand obligations later this month to complete the deal, including $108 million of certificates of participation issued for the Cleveland Browns' new stadium

In advance of the public power sale, Standard & Poor's revised its outlook on the utility to stable from negative, citing CPP's improved ability to compete in the market. The rating agency affirmed its A-minus on the system's outstanding debt as well as the upcoming issue.

"The outlook revision reflects CPP's improving competitive position versus its primary competition, Cleveland Electric Illuminating Co.," wrote Standard & Poor's analyst Jeffrey Panger in a report. Cleveland Electric Illuminating Co. is one of seven electric companies run by FirstEnergy Corp., an Ohio-based, investor-owned electric company that is the fifth largest in the nation. "The stable outlook also reflects improved debt service coverage in 2007," Panger said.

CPP has had debt service coverage averaging 1.92 times between 2002 and 2007. Analysts expect the coverage to remain in the two-times range through 2012.

Moody'sassigned an A2 rating to the bonds, and also cited the competitive market as one of the utility's top challenges.

CPP serves commercial, industrial, and residential customers, and in 2007 supplied power to more than 75,000 customers, or about 40% of the city's customers. The utility currently operates in about 60% of the city, and the expansion plan will increase that area, Hoffmann said. CPP and FirstEnergy have been in competition for the city's electricity customers since 1906.

Under the first phase of the expansion plan, the utility will spend $5 million to construct a new transmission line, also known as the fourth interconnect. The 138-kilovolt interconnect will allow CPP to increase its total load factor from 380 megavolts to 630 megavolts.

Also under the plan, the utility will construct two substations, one located in downtown Cleveland and one in the southern section of the city, which will allow CPP to increase service to existing customers as well as reach new customers.

"CPP's system expansion plan appears to be based on reasonable assumptions on customer growth and projected financial results," wrote Moody's analyst Dan Aschenbach in a report accompanying the sale.

The expansion plan in part will allow CPP to be more competitive with FirstEnergy, which currently operates across the entire city as well as many suburbs, according to Hruby.

One of CPP's current competitive advantages is that it charges slightly less than FirstEnergy, Aschenbach noted. But that rate advantage is vulnerable to volatility in the wholesale energy market, as CPP passes on the cost of energy directly to its customers.

Part of its price advantage comes from its city-owned structure - the City Council has unregulated authority to set rate prices. In contrast, FirstEnergy's rates are set and regulated by the Ohio Public Utilities Commission, and is it expected later this year that the rate caps will expire, likely translating into higher prices for FirstEnergy customers.

"CPP's competitive position versus First Energy had been deteriorating, but that has also improved over the last couple years," Hoffmann said. "They've now been at roughly a 10% advantage over FirstEnergy on small and large commercial and industrial customers, and a 4% to 5% advantage with residential customers."

Besides the competition, one of the utility's top challenges is volatility of energy prices in the wholesale market, analysts said. Part of that risk will be lessened with CPP's planned participation in several American Municipal Power Inc. generation projects in the future, including the giant Midwestern power project, the Prairie State Project. For that project, CPP has agreed to buy up to 25 megawatts of base load power from AMP-Ohio, one of the owners of the Prairie State project.

Panger warned of the risks, including delayed construction, higher fixed costs, and future costs related to new environmental standards. Standard & Poor's did not factor these contracts into its rating.

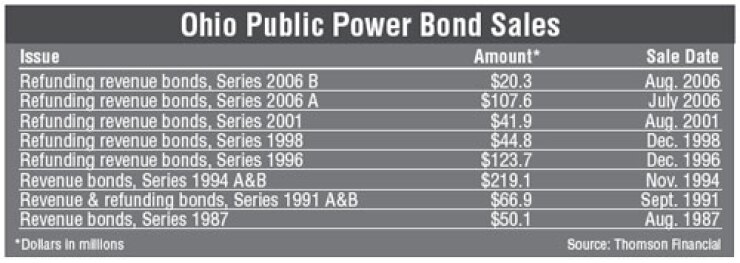

This week's sale should satisfy the utility's need for new-money borrowing for the near future, Hoffmann said. While CPP has refunded some of its debt over the years, it generally has maintained a pay-as-you-go method for its capital plans, and this new-money issue will be the utility's first since 1994.