The Puerto Rico Electric Power Authority may issue prepaid gas bonds in the future to help capture lower fuel and gas costs.

The authority selected Goldman, Sachs & Co. to lead the potential bond deal and Jorge Irizarry, president of the Government Development Bank for Puerto Rico, the commonwealth's financing arm, said a transaction could take place within the year.

"We're still analyzing the structure and it's interesting because it saves a significant amount of money if we do it," Irizarry said. "But we're still in the very preliminary stage of that. We're still evaluating that prepaid structure."

Officials are still working on the size of the deal and length of a potential contract as the authority has yet to enter into discussions with energy providers.

"We don't know a range yet because once it's decided that we would do it then we have to negotiate with the power providers, the co-generators and that depends on what their appetite is too for how much they would like to be prepaid and how much they're willing to discount," Irizarry said. "That's what determines the savings."

Currently, the authority's non-oil generating sources include EcoElectrica, a natural gas supplier, and AES Puerto Rico, a coal-fired cogeneration facility, according to PREPA's last official statement.

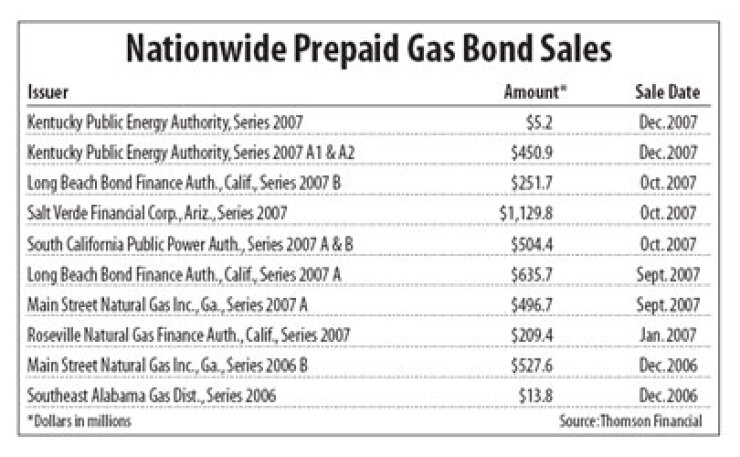

Prepaid gas bonds allow power authorities to lock in lower rates by paying for gas up front for a 20 or 30-year period. In prepaid gas bond transactions, an investment bank acts as a guarantor of the gas supply, with that bank often serving as underwriter on the bonds as well.

While the bank does not guarantee the bonds, analysts say prepaid gas bond transactions depend upon the creditworthiness of the bank. If Goldman Sachs secures PREPA's gas supply, the firm's solid credit standing could help the authority in its transaction.

While other banks have shown losses in 2007, Goldman Sachs held firm, bringing in net earnings of $11.60 billion, $3.22 billion in the fourth quarter. The bank's net revenues last year were $45.99 billion, according to the bank's earning statements. In addition, Goldman carries long-term debt ratings of Aa3 from Moody's Investors Service and AA-minus from Standard & Poor's and Fitch Ratings.

"The credit strength of these types of transactions come from the guarantor like Goldman on the delivery on the gas, so that's the important part of the structure as well as some of the other features of the commodity swap," said Moody's analyst Dan Aschenbach.

One feature that could help PREPA is if it enters into prepaid agreements with different types of gas suppliers - for instance, both natural and coal-generating plants - the authority would still have other sources of gas supply.

"The more diversity you have, the less risk you have with one fuel," Aschenbach said.

PREPA has seven plants serving about 1.5 million electric customers that include a diverse revenue base consisting of 35% residential customers, 45% commercial clients, and 18% industrial customers. q