The Bond Buyer's weekly yield indexes mostly declined this week, as Treasury market gains carried municipals to a decidedly positive string of sessions.

Fred Yosca, managing director and head of trading at BNY Capital Markets, said that a "major turnaround in Treasuries," which saw 10-year note yields drop 26 basis points, along with "continued retail-driven interest" were the major factors helping to drive muni yields lower.

"We can't keep pre-refunded bonds on the shelf long enough. That's a seller's market, boy," Yosca said. "And further out the curve, the retail demand isn't as fevered as it was, but there's still good interest. And the supply still hasn't gotten out of hand. They keep talking about all this pent-up supply, but it still seems manageable. There's certainly enough demand to meet the new deals."

Munis were firmer by two or three basis points Friday, before coming in unchanged to slightly firmer on Monday.

On Tuesday, tax-exempts were slightly firmer as the nation voted to elect a new president. Traders said tax-exempt yields finished lower by one to three basis points after Treasuries firmed up late in the session. Earlier, municipals had little direction and were largely unchanged.

In the new-issue market Tuesday, Merrill Lynch & Co. priced $201.2 million of University of Pennsylvania health system revenue bonds for the Pennsylvania Higher Educational Facilities Authority.

Munis were again firmer Wednesday, following Treasuries. Traders said tax-exempt yields were lower by three or four basis points.

The municipal market was firmer by two to four basis points overall yesterday, again following Treasury gains. In the new-issue market, Goldman, Sachs & Co. priced $350 million of power system revenue bonds for the Los Angeles Department of Water and Power.

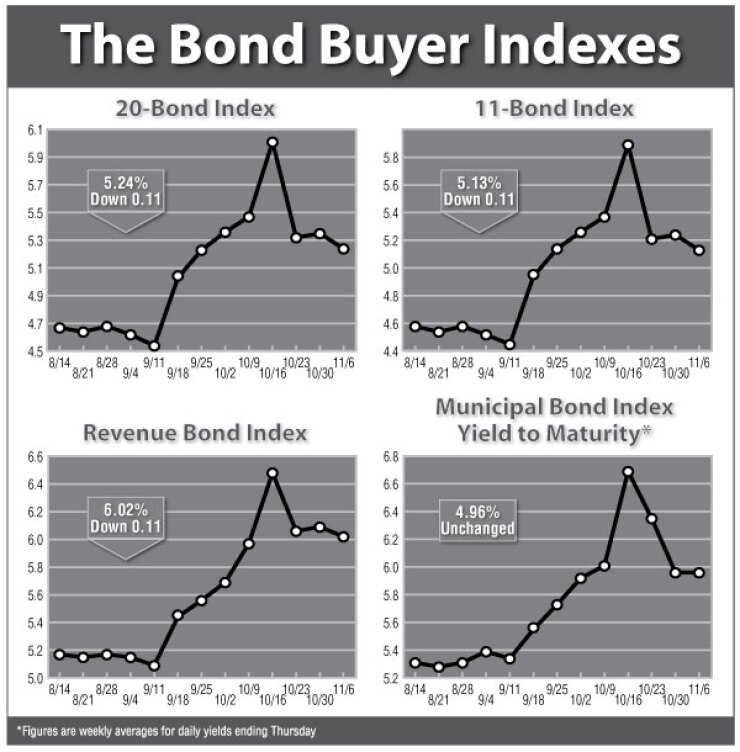

The Bond Buyer 20-bond index of GO yields fell 11 basis points this week to 5.24%, which is its lowest level since Sept. 25, when it was 5.23%.

The 11-bond index also fell 11 basis points this week, to 5.13%, which is the lowest it has been since Sept. 18, when it was 4.94%.

The revenue bond index fell seven basis points this week to 6.02%, which is its lowest level since Oct. 9, when it was 5.97%.

The 10-year Treasury note yield fell 26 basis points this week to 3.68%, but it remained above its 3.60% level from two weeks ago.

The 30-year Treasury bond yield fell 11 basis points this week to 4.18%, but that was still above its level from two weeks ago, when it reached an all-time low of 3.99%.

The Bond Buyer one-year note index fell 30 basis points this week to 1.70%, which is the lowest it has been since Sept. 10, when it was 1.61%. The index has declined 99 basis points in three weeks.

The weekly average yield to maturity on The Bond Buyer 40-bond municipal bond index finished at 5.96%, unchanged from last week.