SAN FRANCISCO - Barclays Capital restarted Lehman Brothers Inc.'s municipal bond trading desk and remarketing operations yesterday.

Barclays last week agreed to buy the bulk of Lehman's North American broker-dealer assets from its bankrupt parent company, Lehman Brothers Holdings Inc., and the deal was approved by a federal bankruptcy court over the weekend. Lehman's muni desk was the first fixed-income business line to begin trading under the new parent company's name.

"Barclays Capital is committed to providing its clients with the same quality service and innovative solutions that they have come to expect from Lehman Brothers' municipal finance business," said Peter Truell, Barclays Capital spokesman. "We look forward to continuing this partnership with our customers."

Lehman was the sixth most active lead underwriter of municipal bonds in the first half of this year, raising $18.4 billion for local governments, hospitals and non-profits, according to Thomson Reuters. Lehman listed 121 public finance professionals in the most recent edition of The Bond Buyer's Municipal Marketplace directory.

Barclays has not said how many of the public finance staff will retain their jobs, but it has said it remains "committed" to the practice. Lehman public finance employees - who declined to be quoted by name because they are not authorized to speak on behalf of the firm - said they were relieved that Barclays snapped up the broker-dealer because the bank didn't have a muni business, suggesting fewer layoffs.

The question now is how many clients or employees get lost to competitors in the transition. Because of the bankruptcy, Barclays had to rush to take over the broker-dealer business in just days - as compared to the nearly four-month integration being planned for Bank of America Corp.'s purchase of Merrill Lynch & Co.

The transition took a few days because Barclays had to move accounts, assets, and clients from Lehman to Barclays very carefully to avoid running afoul of either the bankruptcy court or regulators from the Securities Investor Protection Corporation, which is overseeing the liquidation of Lehman's broker-dealer.

That's meant some fairly major bumps in the transition and some lost business.

Lehman wasn't able to remarket many variable-rate demand obligations that were scheduled to reset earlier this week, forcing municipal bond issuers to tap bank lines of credit to rollover debt. Several clients are considering or already have replaced Lehman as their remarketing agent.

The Illinois State Toll Highway Authority, the Bay Area Toll Authority in Oakland, Calif. and other local governments saw hundreds of millions of dollars worth of VRDOs put back to the liquidity and letter-of-credit banks this week.

BATA last week replaced Lehman as the remarketing agent on about $125 million of variable-rate demand obligations, moving the business to Banc of America Securities to be sure that its debt would not get trapped in the bankruptcy, said chief financial officer Brian Mayhew.

He was not able to remove Lehman as remarketing agent on about $175 million, getting caught in the debt when the SIPC moved to liquidate the firm's broker-dealer unit last week. Now that he knows the Barclays takeover is going to be quick, he intends to keep that remarketing business with Barclays.

"I signed off on the letter last night," he said, adding that he's generally been happy with the work Lehman's done for him.

In fact, Lehman accidentally gave him some of the best rates in his variable-rate portfolio by failing to remarket his bonds this week. They got put back to the bank at 6%, while the rest of his variable-rate portfolio averaged in the 7% to 8% range because of the broader market disruption.

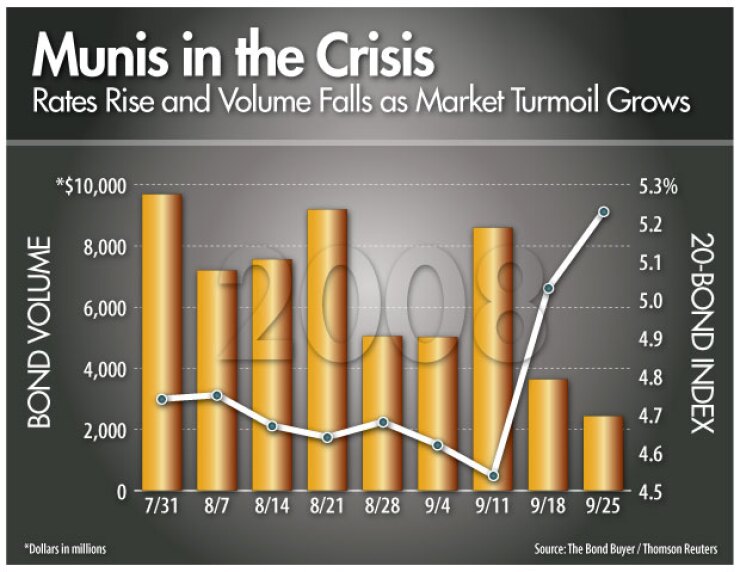

The Securities Industry and Financial Markets Association Municipal Swap Index swap index reset at 7.96% Monday up from 5.15% last week, and from 1.79% the previous week, according to Municipal Market Data. This week's data hasn't been released to the press yet, but it is widely expected to rise even more.

The Illinois State Toll Highway Authority at its board meeting yesterday approved measures that pave the way for the authority's finance chief to reassign a tranche of variable rate demand bonds currently remarketed by Lehman to Goldman, Sachs & Co.

Finance officials are still working out details of the change, however, said authority finance chief Michael Colsch.

The $383 million tranche is remarketed weekly and most recently was reset at about 7.75%, although a good chunk of the bonds have been tendered and are now being held by the liquidity provider. The authority pays the prime rate, which is 5%, on those bonds.

The board also approved similar reassignments for two other tranches of tollway debt in which UBS Securities LLC, which has withdrawn from public finance, serves as the remarketing agent. One will go to JPMorgan and the other to Banc of America Securities.

"We looked at the several different series and obviously it's been in the works to make a change on the UBS series," Colsch said. "We've had some discussions more recently with Lehman and thought it was in our best interest to move forward given the uncertainty with the firm."

The authority has about $1.67 billion of floating-rate bonds, all of which has been converted to a synthetic fixed rate. Lehman did not serve as a counterparty on any of the swaps. The tollway's rates on the floating-rate debt have captured interest rates in line with SIFMA.

The District of Columbia is considering sticking with Barclays, Treasurer Lasana Mack said yesterday. Lehman successfully remarketed about $125 million of variable-rate demand obligations for the district on Wednesday with the interest rates reset at 7.75%.

The rates were about the same on an $475 million of VRDOs remarketed by other firms, Mack said, citing poor market conditions as the reason for the overall spike. The district's VRDOs last week had rates of 5.5%, up from 2.5% a week earlier.

Mack said that Lehman on Wednesday notified the district that Barclay's was taking the reins of the remarketing business, and the district is "strongly considering" a new agreement with Barclays to take over for Lehman.

Rates are "just bad across the board," Mack said. "It's really related to the liquidity crunch, and what's going on with money market funds. Hopefully [the $700 billion bailout] will get to some resolution and that will help the market return to some sense of normalcy."

Lynne Funk and Yvette Shields contributed to this story.