Massachusetts will return to the market today with its first general obligation bond deal in a year, a $661.8 million offering that will not include insurance.

While part the transaction's structure is straightforward - 30-year, fixed-rate bonds - the commonwealth will sell the debt without any enhancement and rely solely on its double-A ratings. Last year, the Bay State sold $1.1 billion of GO debt on Aug. 8, with Financial Security Assurance Inc. and Ambac Assurance Corp. wrapping all of the debt except for $42.6 million of bonds maturing at the short-end of the curve, 2008 through 2010.

Massachusetts isn't alone in choosing to issue debt without insurance. Puerto Rico on Thursday will price $250 million of new-money, GO debt without enhancement, according to Jorge Irizarry, president of the Government Development Bank for Puerto Rico, the island's financial adviser. Puerto Rico carries Baa3 and BBB-minus ratings from Moody's Investors Service and Standard & Poor's, respectively.

Matt Fabian, managing director at Municipal Market Advisors, pointed to the recent $349 million Kentucky Economic Development Finance Authority bond sale that priced Aug. 27 with Assured Guaranty Corp. insuring the debt. Assured carries triple-A ratings with a stable outlook from Standard & Poor's and Fitch Ratings. Moody's rates the monoline Aaa, yet in July placed Assured on review for possible downgrade.

"It was 6% coupons priced at a discount, so even Assured isn't providing that much of a pick-up in the market, and Assured is probably the strongest insurer that we have," Fabian said. "At this point, you would think that Assured should be perceived as the strongest bond insurer out there, beside [Berkshire Hathaway Assurance Corp.], and even there bond insurance didn't help them. It didn't shield the issuer from what are very high rates. So in the context of that, it's really not surprising that Massachusetts should forgo bond insurance entirely."

Massachusetts officials are confident that the state's credit quality will assist the commonwealth at pricing. Fitch and Standard & Poor's rate the transaction AA while Moody's assigns its Aa2 rating to the deal. Massachusetts has roughly $29 billion of outstanding debt.

"It's clear there's a lot of demand for high-quality bonds in this market and we think Massachusetts is a very strong credit," said Colin MacNaught, the state's assistant treasurer for debt management.

Citi will lead a syndicate of 21 bankers. Pricing will begin today for retail investors, with institutional pricing to begin Thursday. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo PC is bond counsel. There is no outside financial adviser.

The transaction includes serials from 2009 through 2028 and two term bonds for $36.5 million and $46.9 million, maturing in 2033 and 2038, respectively.

Of the $661.8 million, $500 million will support infrastructure improvements throughout the state while roughly $162 million will refinance auction-rate Series 2007 D-1 and D-2 bonds into fixed-rate debt.

There are two floating-to-fixed rate SIFMA swaps attached to the auction-rate securities that the commonwealth will now apply to a portion of its $1 billion of unhedged variable-rate debt. The swap agreements include the state paying a fixed rate of 3.942% while receiving floating-rate payments from Merrill Lynch & Co. and JPMorgan.

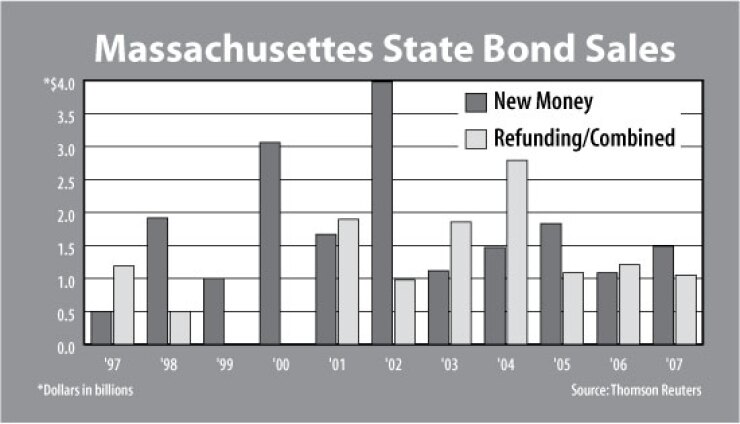

Today's offering is smaller than the state's last GO deal in 2007, which totaled $1.1 billion. Last year, officials wanted to sell one large portion of debt to support capital needs throughout fiscal 2008. The state's strategy has changed for the current fiscal year, which began on July 1, and officials anticipate selling debt on a quarterly basis or when needs require.

"The shape of the yield curve dictates that we'll go back to quarterly borrowing," MacNaught said.

Fabian said the steeper yield curve attracts more retail interest than institutional buyers, an issue that Massachusetts has taken into account in structuring the deal.

"It shows just how reactive the commonwealth is to market conditions. There's no demand from [tender option bonds], institutional demand is much choppier across the curve, and the only reliable support is all in the first 10 years because of retail," Fabian said. "So I think it's a good strategy to have smaller sales and hopefully the market will improve a bit. Longer spreads may come in a bit, and they can take advantage of that. So this is an opportunistic structure that really should advantage the commonwealth."