BRADENTON, Fla. - Jefferson County, Ala., this week moved closer to what would be the largest municipal bankruptcy filing since Orange County, Calif., sought protection from creditors in the 1990s.

The formerly divided Jefferson County Commission came together in recent days to draw a line in the sand with creditors, indicating it would not seek to extend debt forbearance agreements yet again. The county's latest forbearance agreements are set to be terminated tomorrow because the county has failed to obtain a special session of the Alabama Legislature to consider a solution to its sewer debt crisis.

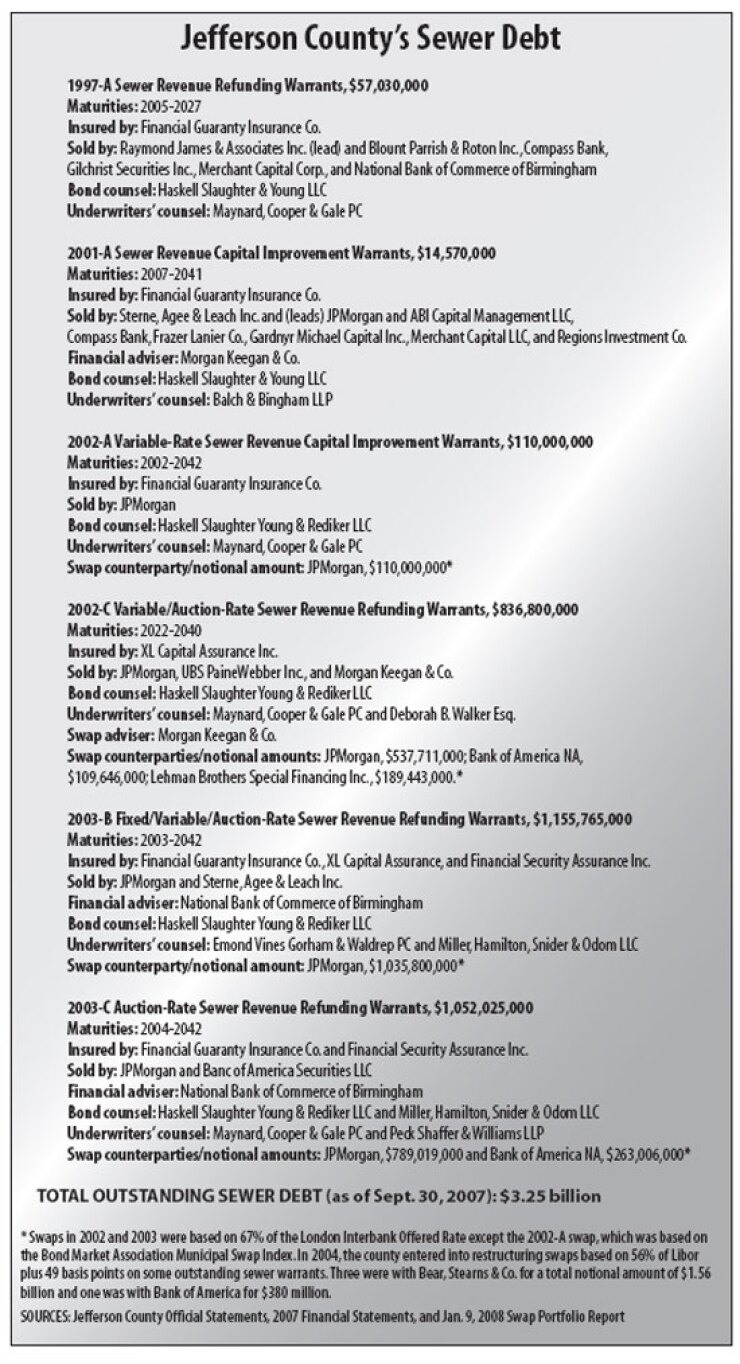

Gov. Bob Riley this week said he would step in to participate in a final effort to reach agreements with creditors, including bond insurers, swap counterparties, and owners of the county's $3.2 billion of troubled sewer debt. But the governor indicated he expects those creditors will have to agree to accept less than they are owed in order to achieve any kind of settlement that would avert a bankruptcy filing.

A termination of the forbearance agreement would trigger a default on some payments owed to creditors, and an actual bankruptcy filing would set the stage for perhaps the largest municipal bond default since the Washington Public Power Supply System defaulted on $2.25 billion of bonds in the 1980s.

It was unclear yesterday how creditors would react to a termination of the forbearance agreements.

"We are working with the county's current advisory team to work through the issues and find a solution to the sewer debt crisis," William Collins, managing director at Scotia Capital, a subsidiary of Scotiabank, said yesterday. Scotiabank is one of the county's liquidity providers.

Many in the county, which includes Birmingham, appear to believe creditors will be reluctant to bring too much pressure to bear on the county. They maintain that many county residents are poor and cannot afford to pay higher sewer rates and possibly higher property taxes to pay off the huge debt incurred to repair the sewer system.

Many also believe they were taken advantage of by Wall Street bankers and others who saddled them with billions of dollars of floating-rate securities and swaps that were supposed to reduce costs but have now blown up in the credit market meltdown.

That public sentiment appears to have finally swayed the five county commissioners - a majority previously were opposed to bankruptcy - to come together in recent days behind a plan that includes seeking protection from creditors in court if necessary.

Hanson Slaughter, senior managing director and head of public finance for Sterne, Agee & Leach Inc., an underwriter of the county's outstanding sewer debt, said Tuesday: "As we have said all along, the Jefferson County sewer crisis was a state problem, not just a local problem. We are pleased the governor has agreed to help resolve the pending crisis and we wish him good luck."

Slaughter noted that Sterne Agee is headquartered in Jefferson County "and half of our 600 employees nationwide reside in the Birmingham metropolitan area. We are committed to the welfare of our employees and to the county in which we all live and therefore remain ready to assist the governor and his negotiating team in any way we can going forward."

Commissioners this week dismissed its most recent financial team working to come up with a restructuring plan. That group was comprised of Sterne Agee, Citi, and Morgan Keegan & Co.

Hanson Slaughter is the son of Birmingham lawyer Bill Slaughter of Haskell Slaughter Young & Rediker LLC. The law firm acted as bond counsel on the sewer debt and recently was acting as lead negotiator with creditors. Commissioners dismissed the firm this week.

If Jefferson County defaults on its debt after the forbearance agreements terminate tomorrow, bond insurers would have to step in to make timely payments of principal and interest.

Insurers with the largest exposure to Jefferson County's sewer debt are Financial Guaranty Insurance Co., with net par exposure of $1.19 billion, and Syncora Guarantee Inc. - formerly XL Capital Assurance Inc. - which has $809 million of exposure.

Both insurers have been badly mauled by the credit crisis. Both have lost their triple-A ratings and seen their credit status downgraded to junk or near-junk status. Both have said in past statements that they would honor their contracts with Jefferson County.

Those rating downgrades helped trigger the county's financial crisis, sending rates sharply higher for the county's auction- and variable-rate debt.

Financial Security Assurance Inc., one of few insurers retaining triple-A ratings, has approximately $352 million of gross par exposure to Jefferson County's sewer debt.

All three insurers declined to comment on the prospect of Jefferson County defaulting, or actions that occurred this week.

As is customary, bond insurance contracts require the county to ultimately repay the insurers. If the county refuses to repay the insurers, or other debts such as those owed to liquidity banks, the creditors could go to court and ask a judge to enforce contracts and bond documents.

Payments the county may face upon termination of the forbearance agreements include accelerated repayment of $847 million of variable-rate demand sewer debt now held by liquidity banks. Repayment or refunding of $2.2 billion of auction-rate securities, some of which have seen penalty interest rates as high as 10%. And as much as $184 million to terminate 13 swaps on which the county defaulted in March.

County commissioners this week ordered attorneys to prepare for a Chapter 9 municipal bankruptcy filing. No time frame was discussed about when the county might decide to make a filing.

County Commission President Bettye Fine Collins on Monday said no agreement had been reached to negotiate new forbearance agreements. Those agreements were to expire in mid-November, but they included early termination triggers. The first trigger: a failure by the governor to call a special session before Aug. 29.

Riley's refusal to call a special session of the Legislature is expected to result in termination of the agreement at 5 p.m. central time. Riley refused to call a session because a restructuring plan, proposed by a majority of the commission to avoid filing bankruptcy, was not supported by many lawmakers. It would have required legislators to make changes in state law and approve a statewide referendum so the county could use other funding streams to pay off the sewer debt.

On Tuesday, County commissioners voted 4 to 0 to have the governor and the law firm Bradley, Arant, Rose & White LLP take over negotiations with creditors in a last-ditch effort to restructure the sewer debt and avoid a bankruptcy filing. Bradley Arant also was authorized to prepare the paperwork for a bankruptcy filing if negotiations are unsuccessful.

Riley told the Birmingham News earlier in the week that a restructuring plan would be presented to Jefferson County's creditors that would require bondholders to take a loss on their investments. He provided no details about the plan.

"I've said all along, if there's a possibility or if there's a way to stay out of bankruptcy, we should," Riley told the newspaper. "But to transfer that burden to the taxpayers of Jefferson County is something I would have a difficult time understanding."

Riley also said the County Commission's preparation for bankruptcy is in all likelihood an attempt to extract concessions from creditors.

In a related action on Tuesday, Alabama Attorney General Troy King issued an opinion stating that the county would need an act of the Legislature in order to place a nonbinding referendum on the November ballot regarding the sewer system on the ballot.

A majority of the County Commission voted to hold a referendum asking local voters what action they should take to resolve the financial crisis. The commission has not responded to King's opinion.

Meanwhile, Standard & Poor's yesterday dropped all but one of the county's non-sewer credits to below investment grade, reflecting the actions taken by the commission this week and "a greater probability that the county will proceed with a bankruptcy filing."

Standard & Poor's lowered its underlying ratings on the county's general obligation warrants to B from BBB.