CHICAGO - Chicago Public Schools will tap $100 million from its reserves and shift the timing of its new-money bond sale to stave off the need for a property tax increase to close a deficit in its $5.14 billion operating budget for fiscal 2009.

The district, which issues its debt under the Chicago Board of Education name, announced last week its decision to forgo a property tax increase for the first time in recent memory. The district has consistently sought property tax increases, many times the maximum amount possible under tax caps, to cope with growing costs and limited increases in state funding.

The school system faced public and political pressure to hold its property tax levy steady given the $83 million property tax increase included in Chicago's 2008 budget and Cook County's recent 1% hike in the area's sales tax. Arne Duncan, the chief executive officer of CPS, and Chicago Mayor Richard Daley, who appoints the board, made the announcement at a news conference last week.

The draw on reserves will bring the balance in that account down to $380 million in the next budget.

"We've never dipped anywhere near this severely. We were planning to take $50 million, we're taking $100 million out and again, we cannot do that again year after year while maintaining our great credit rating with the rating agencies," Duncan said at the news conference.

The administration originally intended to use $50 million, which still left a $100 million hole in the budget. Officials had hoped to close it with additional state aid. Although Illinois gave the district an extra $98 million, officials had been seeking nearly $190 million. So CPS opted to boost its draw on reserves to $100 million which still left a $50 million hole.

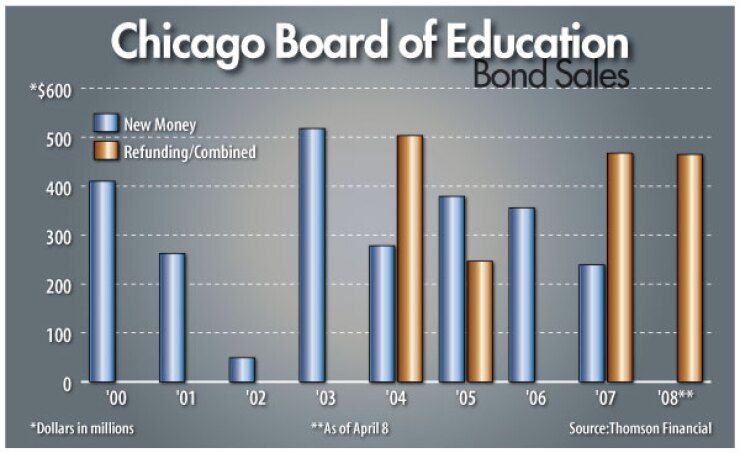

That hole will be closed with $12 million in cuts and $35 million in one-time debt service savings by shifting the timing of the board's new money issue to late next spring. The administration had typically come to market with between $200 million and $300 million in the late summer or fall. "We are constantly reviewing our need for capital spending and to the extent that we can delay a sale and save debt service," said schools treasurer David Bryant.

"We are very pleased," said Lise Valentine, vice president at the business-funded Civic Federation of Chicago, a government watchdog group that has criticized some past school budgets. "It's a recognition on their part of the extraordinary burden on taxpayers. For the Chicago Public Schools to show restraint in their levy sets an excellent example for other taxing bodies."

The $5.14 billion budget is up about 4.3% over the fiscal 2008 spending plan. Capital spending brings the budget up to about $6.15 million. The board will vote on the budget in August. The school system also will continue to push for state passage of a proposed $34 billion capital budget that would help the cash-strapped system keep its $5 billion capital program on track.

Despite its struggles, Fitch Ratings this spring revised its outlook on the board's A-plus credit to positive from stable. Moody's Investors Service rates the district A1 while Standard & Poor's rates it AA-minus.

"The positive outlook is based on an improved financial position and augmented reserve levels ... and enhanced educational programs which have contributed to student achievement," Fitch analysts wrote.

The district earlier this year restructured nearly $1 billion of outstanding auction-rate securities and hopes over the next two months to complete a refunding and insurance substitution on another $310 million of variable-rate demand bonds insured by CIFG Assurance NA that have seen higher rates and failed remarketing since the insurer lost its triple-A from all three rating agencies.