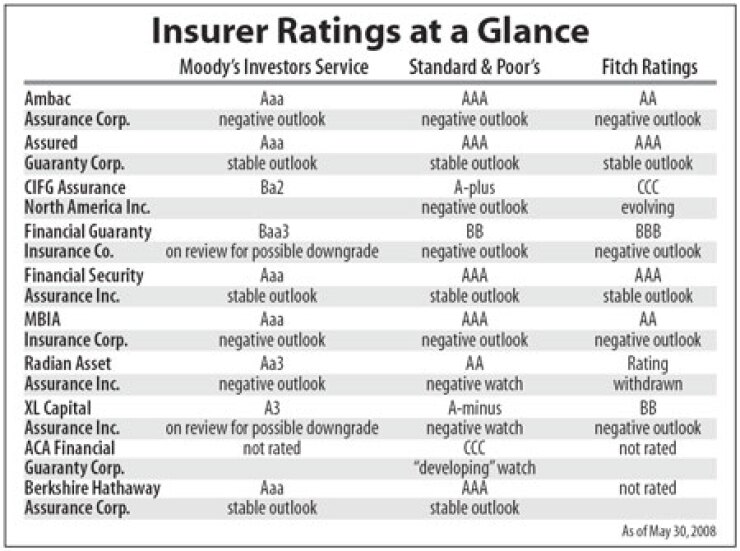

Fitch Ratings Friday knocked the insurer financial strength rating for CIFG Assurance NA 11 notches to junk, dropping it to CCC from A-minus. The rating is on evolving watch.

The downgrade comes little more than a week after Moody's Investors Service took similar action on the bond insurer, sending its rating to Ba2, also junk status.

In its report, Fitch said the decision results from conversations the agency had with CIFG management, in which the bond insurer said it could fall below the minimum regulatory capital requirements if it must raise loss provisions in the coming months. Fitch estimates losses on the collateralized debt obligations insured by the company will reach between $2.6 billion and $3.6 billion.

This could, in turn, trigger insolvency proceedings from regulators and cause the termination of the company's $57 billion credit default swap portfolio. The CDS on the books are used by the company to insure the vast majority of the CDO exposure.

If that were to happen, Fitch said CIFG would not have sufficient claims-paying resources to meet those obligations. The rating agency views CIFG's current claims-paying resources as consistent with a below-investment-grade ratings level.

CIFG continues to look at possible solutions, but has yet to finalize any of them.

"CIFG is focused on developing and implementing strategic alternatives for its problematic credits which will significantly improve the company's capital position," said Michael Ballinger, a spokesman for CIFG.

Fitch said that the severity of the downgrade to CCC is in line with conditions meeting that rating level, including the potential for CIFG to miss payments if its CDS portfolio needs to be terminated at present values. So far, obligations are being paid on a timely basis, according to Fitch.

The rating agency said that any CIFG-insured bonds with ratings lower than A-minus have been downgraded to their underlying ratings. When CIFG was downgraded by Fitch to A-minus, those bonds with lower underlying ratings were knocked down to the level of the insurer, or A-minus.

The downgrades from both rating agencies come despite $1.5 billion contributed to the bond insurer by its parents early in the current market turmoil. As a result, CIFG had looked well capitalized, until recently, when further deterioration in its insured portfolio occurred. Fitch said it was closely following the performance of CDOs containing a large percentage of residential mortgage-backed securities written in 2005.

These RMBS were mostly rated BBB at the time, though they are well below that now, Fitch said.

CIFG exposure to some of the most tarnished classes of RMBS and CDOs was the result of the bond insurer's late entry into the market, and its attempts to catch up to its peers in guaranteeing structured finance credits.

"CIFG was one of the newer entrants to the monoline assurance business and, as such, found that its portfolio was concentrated on 2005-2007 vintage products, including mortgage and CDOs," wrote Guy LeBas, fixed-income strategist at Janney Montgomery Scott, in a recent report.

When Moody's downgraded CIFG last month, a spokesman for the New York State Insurance Department said the bond insurer had not breached the statutory capital threshold. In the event that it did, it would be considered insolvent and the department would get involved, the spokesman said.

If CIFG does fall below statutory levels, it would be forced to address the counter parties on the other end of the $57 billion in CDS contracts. CIFG could secure a forbearance agreement from the counterparties until another solution could be found - as has ACA Financial Guaranty Corp. - or try to convince some of the counterparties to void some of the agreements, which would help CIFG free up some capital.

Since being downgraded by Standard & Poor's to CCC, ACA has negotiated five forbearance agreements with its counterparties. The bond insurer announced the fifth agreement Friday, valid through June 20.